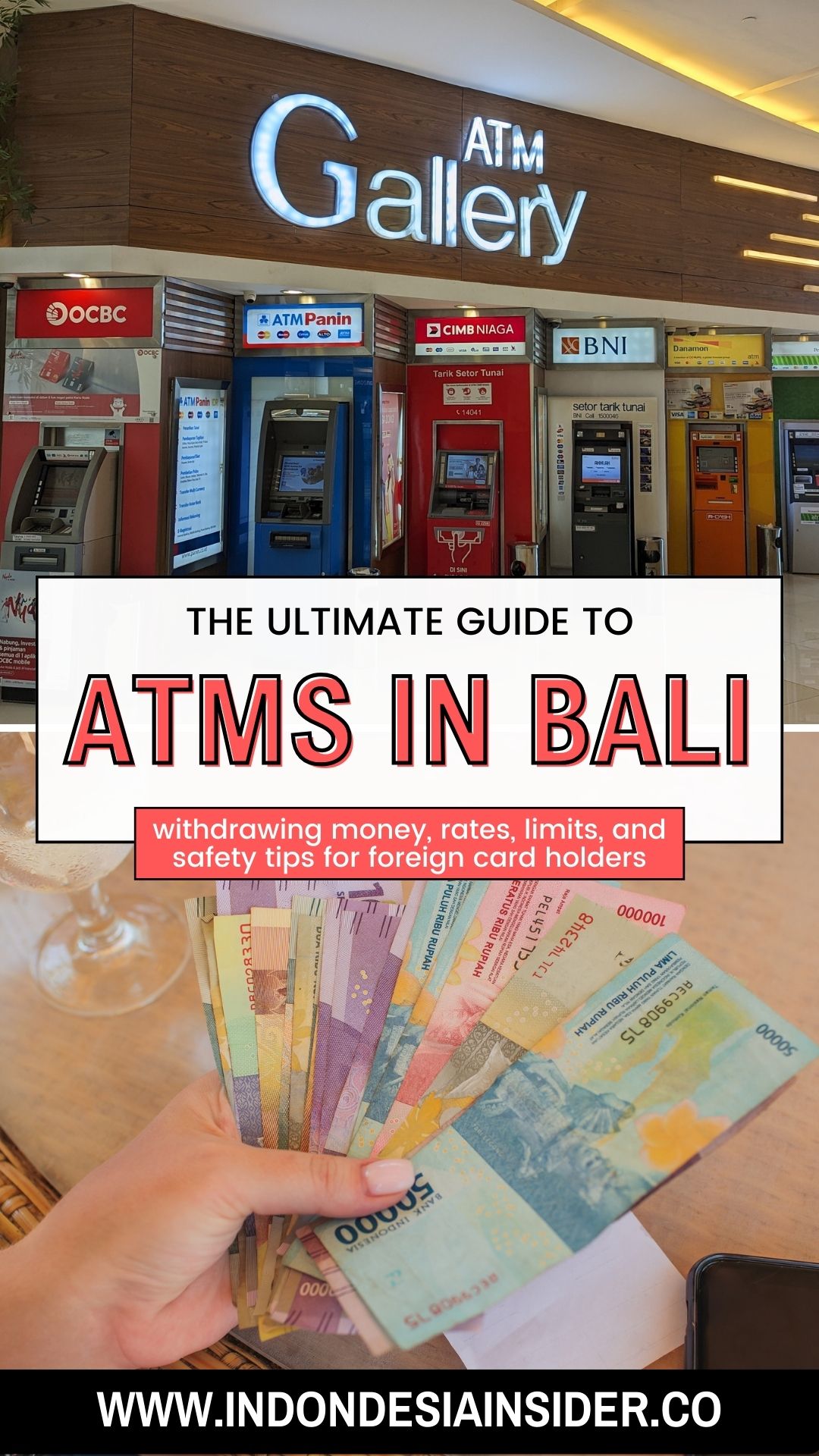

Using ATMs in Bali: withdrawing money, rates, limits, and more!

How to use your foreign ATM card in Bali? This detailed guide gives tips, from finding ATMs in Bali that work to understanding fees to avoid extra costs and ensuring transactions are safe.

Do you want to withdraw cash from a bank with your foreign ATM card while you’re in Bali, Indonesia? When going to Bali, you’ll likely come across places where debit or credit cards aren’t widely accepted.

That means you’ll need cash on hand during your trip. But how can you get your hands on the Indonesian rupiah?

ATMs in Bali are common, so getting the cash you need shouldn’t be too hard. But there aren’t as many ATMs in Indonesia as in many places in the West. Keep reading for tips on ensuring you have enough cash to pay for your trip.

This article will guide you through the process and safety tips for using your ATM in Bali.

🏧 What ATM cards work in Bali Indonesia?

Banks in Bali accommodate foreign ATM debit/credit cards from leading providers such as VISA, Mastercard, American Express (AMEX), and UnionPay.

The following card types are commonly supported:

- VISA

- Mastercard

- American Express

- UnionPay

If your card doesn’t fall under these categories, you can verify the supported card types on the ATM by looking for the relevant logos.

💲 How much are Bali ATM fees?

Over the past decade, ATM fees in Indonesia have experienced a hike. The ATM fee for VISA or Mastercard transaction fees is between $2 USD to $5 USD in many banks. UnionPay and American Express usually charge lower fees, between 50,000 to 150,000 Rupiah per ATM transaction.

Before proceeding with or canceling the transaction, this fee will be displayed on the ATM screen. Moreover, your home bank might also charge a foreign transaction fee for using your card abroad. Extra fees may apply if you opt for currency conversion.

⛔ Is it safe to withdraw money from ATM in Bali?

Using ATMs is typically safe in Bali; be vigilant for potential scams, particularly in tourist-centric areas. ATMs can be used throughout Bali at shopping centers, convenience stores, tourist spots, gas stations, and bank branches.

Ensure your PIN is covered when inputting, and refrain from revealing it to anyone. The safest way for ATM usage is within a bank branch, and try to avoid using the ones inside the convenience stores.

Remember to keep your ATM card secure. If that’s not possible, use your hotel room safe to store it. Always verify the fees before accepting a transaction, as exchange rates and foreign card ATM charges can fluctuate between banks.

Prepare for unforeseen circumstances by carrying a backup ATM card and emergency cash. Secure your backup mode separately from your primary ATM card.

If you lose your ATM cards or suspect a security breach, contact your bank immediately to block the card.

💸 Safest ATMs in Bali, Indonesia

Bank Negara Indonesia

Mandiri

BCA (Bank of Central Asia)

💸 How much money can you take out of an ATM in Bali?

The maximum withdrawal amount with a foreign ATM card is generally $130 USD to $200 UDD or 2,000,000 IDR to 3,000,000 IDR but this limit can vary depending on the bank and your own bank’s policies.

Use the counter withdrawal service inside a banking branch to withdraw more than the maximum ATM amount. This service enables you to withdraw up to your card’s maximum limit.

ATMs in Bali dispense only two denominations; look for a sticker on the ATM that tells you how much money you can get. They only give out 50,000 IDR, worth about $4 USD, and 100,000 IDR, or $7 USD. The best ones are the 100,000 IDR, because $200 USD in Rp50k bills makes a thick bag.

💱 ATM exchange rate in Bali

The currency rate an ATM uses for your transaction is based on the type of card you use (VISA, Mastercard, or UnionPay). On top of your bank’s foreign transaction fee and the ATM fee, the Indonesian bank may also utilize an additional exchange rate.

Exchange rate calculators:

When using an ATM with a foreign card in Bali, Indonesia, you may be presented with an option of conversion using your home currency or without modification in local currency.

Always choose without currency conversion in local currency so your card issuer handles the exchange rate at a competitive market rate.

🏆 Best ATM to use in Bali Indonesia

Most banks have transaction fees from $2 USD to $5 USD, so when withdrawing money from an ATM, consider using banks with lower usage fees per transaction. Also, some banks allow a higher daily maximum withdrawal limit but at a slightly higher usage fee.

Here are the local banks and locators you can check when withdrawing in Bali:

🏦 How to withdraw money in Bali

- Insert your card, select English as your preferred language

- Enter your pin

- Select the withdrawal option

- Select either savings (debit) or credit based on your card type

- Enter the withdrawal amount

- The ATM will present the fee required for the transaction. Either accept or reject the fee. (Rejecting will cancel the withdrawal and return your card)

- If the ATM asks to use home currency conversion (DCC), reject this and select without modification. Be warned; banks sometimes use tricky wording to get you to use conversion!

- If the transaction is successful, your money will be dispensed with the receipt.

- Get your Card***BGB TIP*** Be aware that ATM machines often hand out money before returning your card. Make sure you do not walk away without taking your card!

🙋 Can I withdraw money at ATMs in Bali Airport?

Yes, definitely, after getting through immigration, but before exiting the airport and getting a ride, there are some bank branches on the left side of the exit from customs.

Even though banks aren’t open 24 hours a day (their hours change), ATMs inside the airport are safe to use to get cash.

Unlike other international airports in Southeast Asia, these are all owned and run by big Indonesian banks, which is good because independent ATM providers charge higher fees. This means it is entirely safe to use the ATMs at the Bali airport to get Indonesian Rupiah, the local cash.

✅ How to avoid Indonesian ATM fees

Paying 150,000 IDR to 200,000 IDR to withdraw your cash abroad can feel excessive. An alternative solution is starting money directly at a bank branch counter to evade the ATM fee.

The counter withdrawal service is available nationwide at most major bank branches with an international debit or credit card. However, note that some banks will only offer this service with credit cards.

Some banks provide this service free, but others might charge up to 200,000 Rupiah per withdrawal. Hence, inquire about the fees and the maximum withdrawal limit before proceeding. Remember that your card may impose a foreign transaction fee or cash advance fee.

To avoid unfavorable exchange rates, ensure the bank performs transactions without conversion and not in your home currency. Be on the lookout for any mention of your home currency on the transaction request before approval.

Required documents for counter withdrawal/cash advance

- Valid Credit / Debit card in your name with signature

- Passport with the name matching your card

Steps to withdraw money using cash advance service at an Indonesian bank

- Ask the bank representative for the cash advance service

- Inform the bank teller of your requirements (withdraw amount and local currency)

- Ask about the fees before processing

- Hand over your passport and card

- Documents will be photocopied, and you’ll need to sign them

- The teller will action your transaction through a card terminal

- Enter your card pin or require a signature

💵 Other ways to take money into Bali

Most international banks charge foreign transaction fees while using an ATM card abroad. To avoid additional traveling costs, get a bank with low international transaction fees or sign up for a free multi-currency account with Wise (Formerly TransferWise).

Benefits of using Wise over conventional bank offerings

- Mastercard debit card

- Spend, send, and receive money worldwide

- Personal bank account for supported currencies

- Low currency conversion fees

- Low ATM withdrawals fees (free for two or fewer withdrawals)

- Compentive conversion rates

- An easy-to-use app to keep track of spending

You can use Wise to send money into and out of your Indonesian bank account. This way, you can avoid hidden SWIFT banking fees and get a reasonable rate on currency exchange. You should get a statement before you go on a trip to use it as a backup account.

Should I exchange money before I travel to Bali?

No,if you are using USD, EURO, POUNDS or AUD, exchanging money in Bali is better.

🤑 Opening a local bank account in Bali

Opening a local Indonesian bank account might be worth spreading if you travel to Indonesia often. Fees from using a foreign card can mount up over time.

If you have a local bank ATM from any Indonesian bank, withdrawals from a local bank are free, and you can use a service like Wise to deposit into your Indonesian account from abroad.

Most local banks require a work permit or KITAS, a passport, and proof of local residence to sign and open a bank account in Indonesia.

It’s easy to get tricked by Bali’s hidden fees when you want to get cash out. If you want to use an ATM to get money quickly, be aware of the fee and choose a bank with lower rates.

Or, you can avoid ATM fees by using the cash advance/cash withdrawal service at a large bank branch. Prepare for a disaster by bringing extra cash or another card, and think about getting a card with no fees, like Wise.

Need more information about Bali travel?

![Editor’s Pick: 7 best hostels in Uluwatu Bali [from $13 per night]](https://www.indonesiainsider.co/wp-content/uploads/Bali-Bobo-best-hostel-in-Uluwatu-for-solo-female-travelers-768x614.jpg)